In the fast-paced world of today, access to instant credit has become a necessity for many individuals, particularly in emerging economies like India. Whether it’s an urgent medical expense, unplanned travel, or a sudden financial shortfall, people increasingly rely on financial solutions that are quick, reliable, and easy to access. One such solution is KreditBee, a prominent digital lending platform that has transformed the personal loan landscape in India by offering instant loans with minimal paperwork and maximum convenience.

This article takes an in-depth look at KreditBee, exploring its features, benefits, eligibility criteria, loan application process, and how it compares to other lending platforms.

What is KreditBee?

KreditBee is a leading Indian fintech platform that provides instant personal loans to individuals, primarily targeting young professionals and salaried individuals. Launched in 2018, KreditBee quickly gained popularity due to its user-friendly approach, offering loan amounts ranging from as low as ₹1,000 to ₹4 lakhs. It operates as a completely digital platform, allowing users to apply for loans through its mobile app, with funds disbursed directly into their bank accounts within minutes of approval.

KreditBee has partnered with several leading non-banking financial companies (NBFCs) and banks to facilitate the loan process. The platform focuses on offering short-term loans that can be repaid within a flexible tenure, ranging from 2 months to 15 months, depending on the loan amount and the borrower’s profile.

Features of KreditBee

KreditBee distinguishes itself with several key features that make it a go-to platform for quick personal loans in India:

- Instant Loan Disbursement: One of KreditBee’s standout features is the speed at which loans are processed and disbursed. Once a user is verified and the loan is approved, the funds are typically transferred to their bank account within minutes, making it an ideal solution for emergency financial needs.

- Completely Digital Process: KreditBee eliminates the need for physical paperwork and lengthy verification processes. Users can apply for a loan entirely through the KreditBee mobile app, which is available on both Android and iOS platforms. This hassle-free, paperless process makes loan applications fast, secure, and convenient.

- Flexible Loan Amounts: The platform offers loans ranging from ₹1,000 to ₹4 lakhs, allowing users to borrow as much as they need without borrowing excess funds. This flexibility makes KreditBee suitable for both small, short-term needs and larger financial requirements.

- Minimal Eligibility Requirements: KreditBee is designed to cater to a wide range of users, including first-time borrowers. The eligibility criteria are simple, and the platform offers loans even to those with no prior credit history, making it accessible to a broader population.

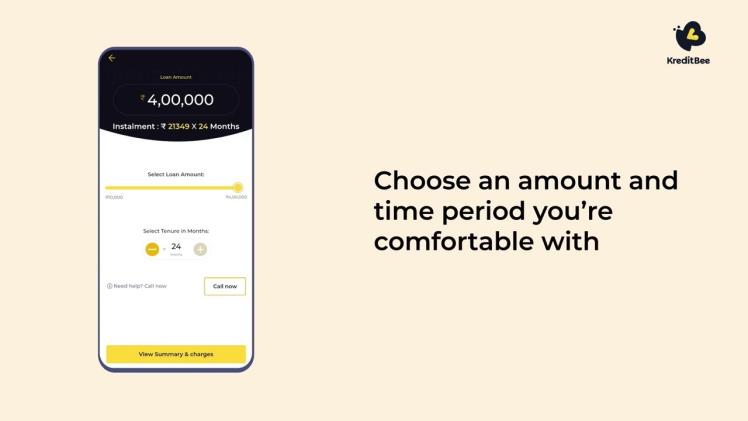

- Flexible Repayment Options: The loan tenure offered by KreditBee ranges from 2 months to 15 months, allowing users to choose a repayment period that suits their financial situation. This flexibility in repayment terms ensures that users do not face unnecessary financial pressure when repaying their loans.

- Multiple Loan Products: KreditBee offers various loan products tailored to meet the diverse needs of borrowers, including Personal Loans, Flexi Personal Loans, and Online Purchase Loans. These options allow users to choose the loan type that best fits their needs, whether it’s for emergency expenses, flexible cash flow, or financing an online purchase.

How to Apply for a Loan on KreditBee

Applying for a loan on KreditBee is straightforward, thanks to its fully digital process. Here’s a step-by-step guide on how to apply:

- Download the KreditBee App: Start by downloading the KreditBee app from the Google Play Store or Apple App Store. Once installed, users need to sign up with their mobile number.

- Complete the Profile: After signing up, users are required to complete their profile by providing basic personal details such as name, age, address, and employment status.

- KYC Verification: KreditBee follows a Know Your Customer (KYC) process, which involves submitting identification documents such as a PAN card and Aadhaar card for verification. This process is quick and typically completed within minutes.

- Loan Selection: Once the profile is verified, users can choose the loan amount and the type of loan they need. The platform provides various loan options based on the user’s credit profile and eligibility.

- Loan Approval and Disbursement: After selecting the loan amount and repayment tenure, users can submit their loan application. KreditBee uses its advanced algorithms to assess the application in real-time, and if approved, the loan amount is disbursed to the user’s bank account almost instantly.

Eligibility Criteria for KreditBee Loans

KreditBee is accessible to a wide range of users due to its minimal eligibility criteria. To apply for a loan, users must meet the following basic requirements:

- Age: The applicant must be between 21 and 56 years old.

- Employment Status: The applicant should be a salaried professional or self-employed.

- Income: While KreditBee doesn’t require a specific income level, it evaluates the user’s creditworthiness based on their financial profile, including income and other factors.

- Indian Resident: The applicant must be a resident of India and possess valid ID and address proof (such as PAN and Aadhaar).

KreditBee’s inclusive approach allows even those with little or no credit history to access loans, making it a popular choice among young professionals and first-time borrowers.

Interest Rates and Fees

The interest rates on KreditBee loans vary depending on the loan amount, repayment tenure, and the borrower’s credit profile. Typically, the interest rates range from 15% to 29.95% per annum. Additionally, KreditBee charges a processing fee that ranges between 2% to 3% of the loan amount, depending on the loan product.

While the interest rates on KreditBee loans may be higher compared to traditional bank loans, the trade-off comes in the form of convenience, speed, and ease of access, especially for those without a strong credit history.

Pros and Cons of KreditBee

Like any financial product, KreditBee has its advantages and disadvantages:

Pros:

- Quick Approval and Disbursement: KreditBee is an ideal option for users who need funds immediately, with loans disbursed within minutes of approval.

- Fully Digital Platform: No need for physical paperwork or lengthy processes—everything is handled through the app.

- Accessible to First-Time Borrowers: KreditBee’s inclusive approach makes it accessible to users with no prior credit history.

- Flexible Loan Options: Users can choose from different loan types and repayment tenures, ensuring flexibility.

Cons:

- High-Interest Rates: The interest rates can be higher compared to traditional loans, which may be a disadvantage for those looking for lower-cost credit.

- Processing Fees: KreditBee charges a processing fee, which adds to the cost of borrowing.

How KreditBee Stacks Up Against Competitors

KreditBee faces competition from other digital lending platforms in India, such as EarlySalary, MoneyTap, and CASHe. However, KreditBee stands out due to its wider loan range, flexibility in repayment, and simple eligibility criteria. It’s particularly popular among first-time borrowers and those in urgent need of small, short-term loans.

Conclusion

KreditBee has revolutionized the personal loan market in India by offering quick, accessible, and flexible loans to a broad audience. Its fully digital platform, combined with rapid loan disbursal and inclusive eligibility criteria, makes it a leading choice for individuals seeking instant financial solutions. While its higher interest rates may be a drawback for some, the convenience and speed of KreditBee’s services make it an attractive option for those in need of urgent credit. As India’s fintech landscape continues to evolve, KreditBee remains at the forefront, empowering individuals with the financial flexibility they need to meet life’s unpredictable challenges.